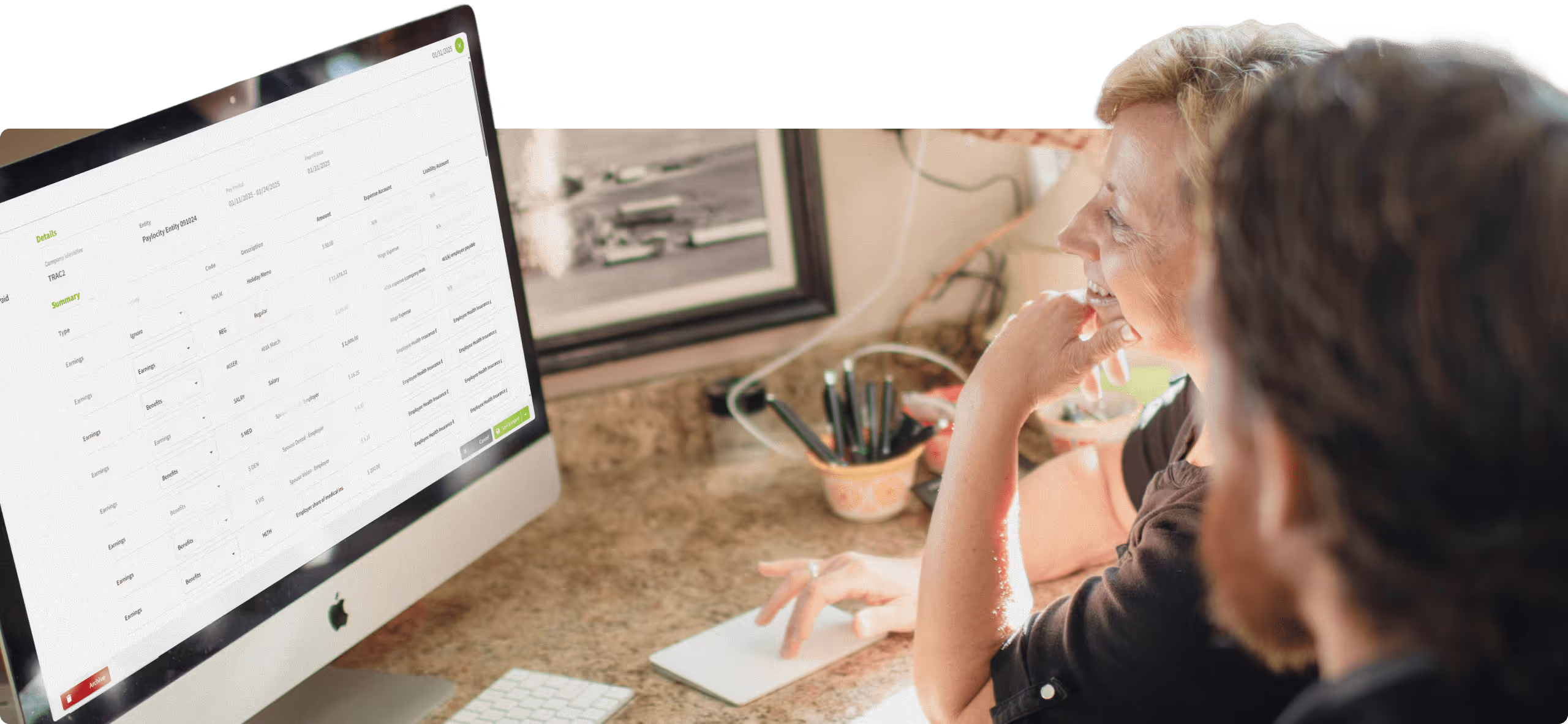

Payroll solutions for your farm business

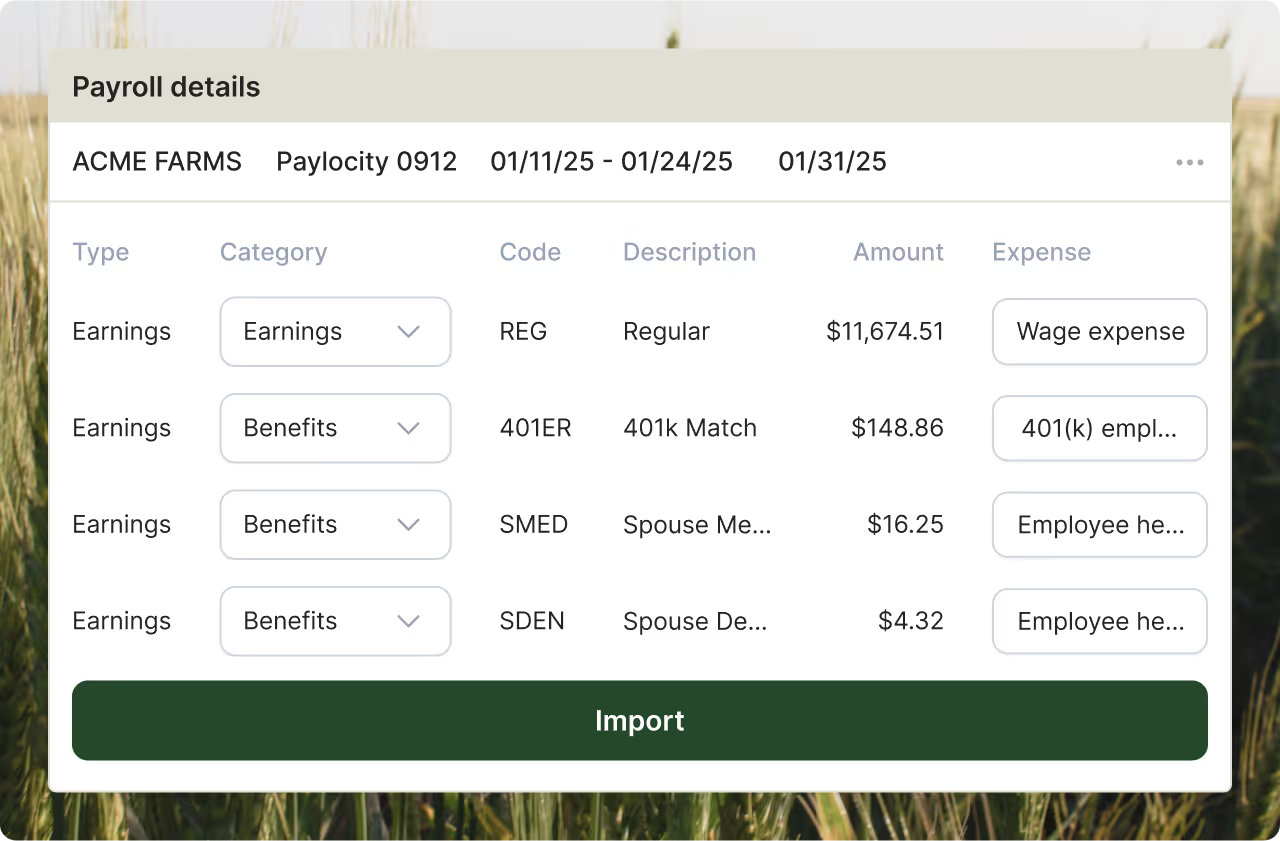

Rely on our Paylocity integration to speed up payroll processing and tax compliance for you and your employees.

Compliance, accuracy, and peace of mind

Save time and reduce risk knowing your payroll is processed accurately and efficiently, and reclaim time to focus on other areas of your business.

Quick & accurate

Built-in time tracking and support for both hourly and salaried employees.

No forgotten forms

Employee I-9s and W-2s are stored and organized online.

All 50 states

Handles the registration process in all the states your employees live and work.

Auto-calculate taxes

Calculates tax withholdings, files, and pays your payroll taxes automatically.

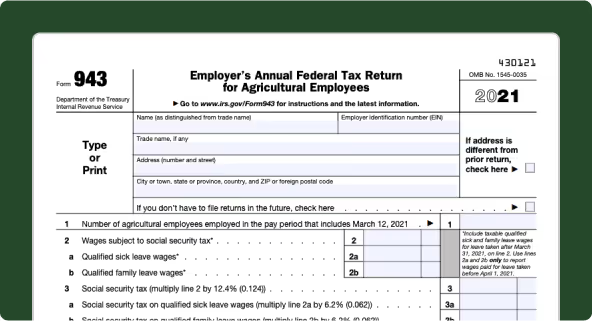

Farm-specific tax forms

Keep both agricultural and non-ag employees in the same system, thanks to our payroll partner that handles your 941, 943, or 940 tax forms. Plus, Paylocity digitally submits forms for you.

Form 943

Used to report wages paid to farmworkers and taxes withheld for Social Security and Medicare.

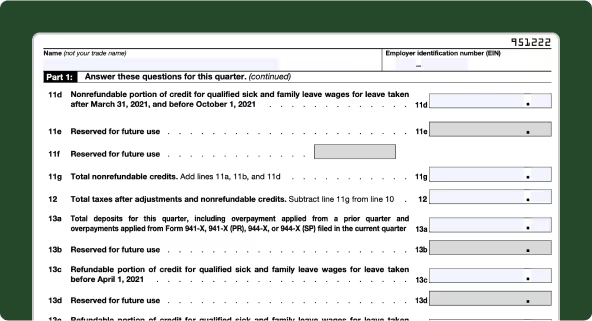

Form 941

Report payroll taxes and submit the employer and employee portions of Social Security and Medicare.

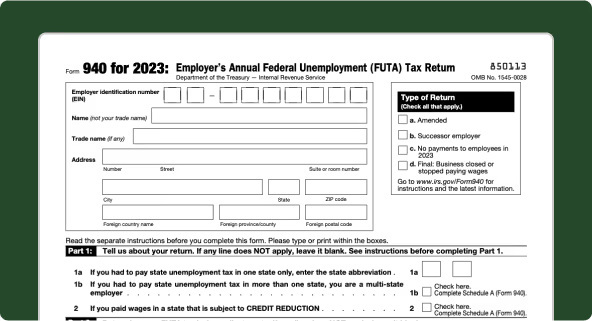

Form 940

Used to file your annual FUTA tax, which helps fund unemployment benefits.

Easily file

Paylocity handles all your tax forms and submits them for you—stress-free and accurate.

Ready to book a Paylocity demo?

Brandon Marling is a Paylocity representative known for his reliability and relationship-driven approach, Brandon helps farmers and bookkeepers simplify payroll processes so they can focus on what matters most.

Discounted pricing for up to five full-time employees start at just $1,400 /year*. Book a quick meeting with Brandon to discuss the precise plan for your farm.

Agape Farms in Ohio